Financial responsibility

Kati Niemelä, CFO, Nordic Morning Plc

Added value for stakeholders

For Nordic Morning, financial responsibility means producing financial added value for the company’s key stakeholders, personnel, customers and owner. Important target groups for added value also include partners, investors and the countries and municipalities in which we operate.

Financial management is based on the Group’s policies and more detailed guidelines concerning the policies, as well as good corporate governance, effective risk management, and the principles of internal control.

The CFO, the Group Finance unit and, ultimately, the CEO and the Board of Directors are responsible for matters related to finance and the financial statements, as well as broader issues related to financial responsibility.

Profitable change management

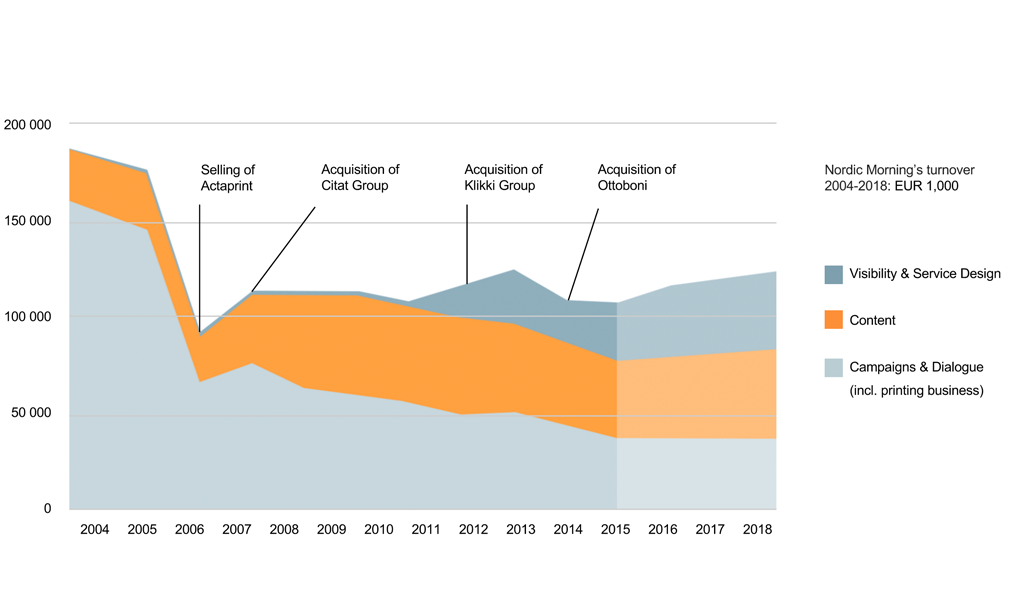

Nordic Morning’s business operations have been systematically transformed over the past decade from a focus on printing production toward solution-oriented consulting and service design to help customers operate in the digital environment. While the rate of change has been very rapid due to the transformation of the market, we have managed to implement the necessary changes profitably.

The extent of the changes is illustrated by the fact that, in 2004, printing operations accounted for 90 percent of the Group’s net revenue, while in 2015 they accounted for only 38 percent, with digital, multichannel, and other services representing the other 62 percent (see below the chart "Nordic Morning's transformation").

In order to achieve this change, the Group has made several acquisitions. Bringing a new company into the Group is always a challenging and many-sided process that requires the integration of people, services, systems, ways of working, and entire company cultures. Successful integration is essential, as it impacts the profitability of the acquired entity and Nordic Morning as a whole.

2015

We began the year by launching a new service strategy and by reorganizing the Group accordingly into three business areas: Visibility & Service Design, Content, and Campaigns & Dialogue.

We strengthened our digital and content services through acquisitions, and implemented several internal restructuring and efficiency improvement measures to raise our customer service and profitability. While we did not achieve all of our profitability and growth targets, we were successful in our strategically significant objective of improving cooperation between Group companies, which was reflected in a substantial increase in joint customer projects.

In the Visibility & Service Design business area in 2015, we acquired Ottoboni, a Swedish company specializing in business and service design, and the smaller Finnish company Alkuvoima, which was merged with Citat to form Ottoboni Finland. Ottoboni is an example of successful integration. The company has quickly found its place in Nordic Morning’s ecosystem, and cooperation with its sister companies has got off to a good start.

We improved the efficiency of our financial administration by establishing a financial administration service in Finland to serve the entire Group. Our statutory accounting and tax functions are centralized in the new unit. The restructuring measure was successful, and we achieved the cost saving targets set for it.

In 2015, Nordic Morning sold products and services to its customers for the total amount of EUR 108.1 million (114.6) and spent EUR 52. million (56.6) on buying goods and services from partners.

We produced financial added value for stakeholders totaling EUR 55.5 million (58.0). Most of this value, EUR 50.6 million (45.7), was distributed to personnel in the form of salaries, pensions and social costs. Dividend EUR 2.0 milloin (1.5) was distributed to the owner.

The Group’s operating profit was EUR -0.2 million (EUR 3.4 million). The operating profit included a significantly lower amount of non-recurring items than in the previous year at EUR -0.2 million (EUR 2.4 million). The Group’s operating profit excluding non-recurring items was EUR -0.1 million (EUR 1.0 million). It was weighed down by profitability issues related to the sheet-fed offset printing business in Sweden.

The Group’s equity ratio was 48.6 percent (51.4 percent). Cash and cash equivalents totaled EUR 4.8 million (EUR 9.3 million).

2016

We will continue the profitable development of the Group by monitoring changes in customer needs and the markets, while also investing in the development and efficiency of internal services.

Internal control and risk management

Good governance, along with active internal control and risk management, effectively secure the profitability of business operations.

We conduct a risk analysis annually in conjunction with budgeting. Risks are reported and dealt with immediately. Taking into account the good level of the company’s internal control and the size of the company, the Board of Directors decided not to issue a separate assignment regarding internal control.

Tax policy

Nordic Morning Group pays taxes on its business income to each operating country in compliance with local laws and regulations. More information on the Group’s tax policy and operating principles can be found at the bottom of the page.

Finance strategy

Nordic Morning’s transformation

Added value for stakeholders

| Stakeholder | Indicator | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 |

|---|---|---|---|---|---|---|---|

| Customers | Sales | 108 060 | 114 628 | 123 576 | 115 491 | 107 611 | 110 882 |

| Suppliers | Cost of goods, materials and services purchased | 52 546 | 56 583 | 65 590 | 58 634 | 50 443 | 50 745 |

| Added value created | 55 514 | 58 045 | 57 986 | 56 857 | 57 168 | 60 137 | |

| Stakeholder | Indicator | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 |

| Employees | Wages and salaries, pensions, social costs | 50 645 | 45 671 | 48 393 | 51 273 | 48 798 | 50 342 |

| Public sector | Direct taxes | -132 | -102 | 123 | -255 | -40 | 244 |

| Financers | Net financing costs | 131 | -49 | -19 | 600 | 707 | 923 |

| Charitable organizations | Donations | 139 | 127 | 124 | 125 | 119 | 128 |

| Owners | Dividends | 2 000 | 1 500 | 0 | 0 | 990 | 1 740 |

| Investors | Investments | 7 786 | 3 980 | 3 379 | 7 368 | 5 017 | 3 312 |

| Total added value distributed to stakeholders | 60 569 | 51 127 | 52 200 | 59 111 | 55 591 | 56 689 | |

| Value added remaining in the company | -5 055 | 6 918 | 5 786 | -2 254 | 1 577 | 3 448 | |

| Added value created / FTE (tEUR) | 78 | 88 | 87 | 81 | 77 | 73 | |

Nordic Morning's tax policy and operating principles

The Nordic Morning Group pays taxes on its business income to the countries it operates in, in compliance with local laws and regulations.

Nordic Morning’s main markets are Finland and Sweden. The company also has minor operations in Ukraine and, through an affiliate, in India. Nordic Morning has no companies nor business in countries considered as tax heaven. The Group’s aim is to secure and increase shareholder value through profitable and efficiently managed business operations. The Group’s tax policy is also aimed at securing shareholder value by ensuring that the local tax legislation of each operating country is always complied with and that taxes are paid to the country in question.

In the Group, tax matters are managed by the Group CFO, who reports on relevant tax matters to the Board’s Audit and Structure Committee and if needed also to Group’s Board. The day-to-day tax affairs of individual legal entities are managed in local accounting units, the operations of which are monitored by auditing.

In tax matters that are open to interpretation or otherwise complicated, support is obtained from external tax advisors, or the tax authorities are requested to provide advance rulings and advice. The Group’s objective is to handle its taxes and other levies in as appropriate and timely a manner as possible, in full compliance with the law.

The Group has prepared a transfer pricing policy that defines the pricing principles for the Group’s internal cross-border trading. The transfer pricing policy is in line with current official guidelines and legislation.

Tax report 2015

In 2015, the Group’s profit before taxes was EUR -0.4 million (3.4 million). The majority of the taxable profit was accrued in Sweden. The Group paid income taxes of EUR 0.1 million (0.1 million). The low amount of income taxes paid was due to confirmed tax losses carried forward from the previous years in Finland and Sweden, which amounted to EUR 12.0 million(17.8 million) at the end of the 2015 financial year. In 2015, the Group’s effective income tax rate was 37% (-3%).

At the end of the year, deferred tax assets stood at EUR 0.01 million (0.1 million) and deferred tax liabilities stood at EUR 0.8 million (0.7 million). According to principal of cautiousness the Group has not booked any deferred tax receivables from taxes carried forward from previous fiscal years.

Of the taxes paid for the financial year, the most significant item was statutory employer’s contributions at EUR 6.0 million (6.3 million), the majority of which was paid to Sweden.

Of the taxes remitted for the financial year, value added tax payments totaled EUR 10.8 million (9.5 million) and withholding taxes totaled EUR 9.4 million (10.2 million).

In addition, the Group also pays other mandatory contributionsand, other tax-like contributions and indirect taxes related to its purchases, such as road tolls, energy taxes and insurance taxes.

Tax contribution

| M€ | Finland | Sweden | Ukraine | Group | |||||

|---|---|---|---|---|---|---|---|---|---|

| 2015 | 2014 | 2015 | 2014 | 2015 | 2014 | 2015 | 2014 | ||

| Turnover | 40.6 | 44.9 | 64.3 | 61.7 | 0.4 | 4.9 | 104.9 | 106.6 | |

| Profit before tax | -0.4 | 2.5 | 0.0 | 0,8 | 0.0 | 0.0 | -0.4 | 3.4 | |

| Utilized tax losses | 1.3 | 5.2 | 2.8 | 0.6 | 0.0 | 0.0 | 4.1 | 5.8 | |

| Personnel | 271 | 286 | 416 | 354 | 22 | 20 | 709 | 660 | |

| Taxes borne 2014-2015 | |||||||||

| Corporate income tax | 0.1 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.1 | 0.1 | |

| Employment taxes | 0.3 | 0.3 | 5.7 | 5.8 | 0.0 | 0.2 | 6.0 | 6.3 | |

| Taxes on property | 0.0 | 0.1 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.1 | |

| Other taxes | 0.0 | 0.0 | 0.6 | 0.5 | 0.0 | 0.0 | 0.6 | 0.5 | |

| VAT, returns in P&L | 0.0 | 0.0 | -2.0 | -1.9 | 0.0 | 0.0 | -2.0 | -1.9 | |

| Taxes remitted 2014-2015 | |||||||||

| Payroll taxes | 4.1 | 4.7 | 5.3 | 5.4 | 0.1 | 0.1 | 9.4 | 10.2 | |

| Tax at source | 0.0 | 0.0 | 0.6 | 0.6 | 0.0 | 0.0 | 0.6 | 0.6 | |

| Sales VAT | 9.6 | 11.7 | 17.3 | 14.8 | 0.0 | 0.0 | 26.9 | 26.5 | |

| VAT, purchases | -5.9 | -6.9 | -10.2 | -10.2 | 0.0 | 0.0 | -16.1 | -17.0 | |

| VAT, returns | 0.0 | 0.0 | -0.1 | -2.5 | 0.0 | 0.0 | -0.1 | -2.5 | |

| Excise tax | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | |

| Other taxes | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | |